79

views

views

Bitcoin Cash surges past resistance, signaling bullish momentum and fueling optimism around Bitcoin Cash price prediction 2025 and future gains.

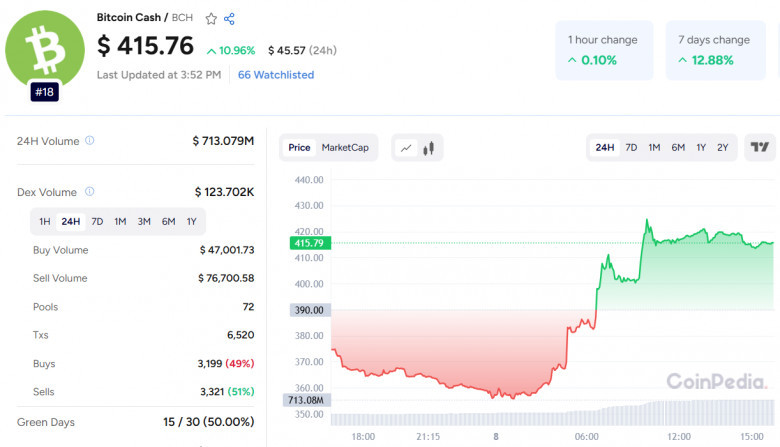

Bitcoin Cash (BCH) has posted a strong performance in the last 24 hours, surging by 10.97% to reach $415.79 at the time of writing. Backed by a 24-hour trading volume of over $713 million, BCH has decisively broken out of its months-long consolidation phase, signaling a major shift in market structure. This breakout also adds weight to the optimistic Bitcoin Cash price prediction 2025, with bullish analysts now eyeing higher targets as momentum builds.

The recent breakout above the critical resistance level of $378.20 has been confirmed by a strong weekly candle close. This breakout not only invalidates the prolonged sideways trend but also sets the stage for a continued bullish move. With price action holding comfortably above the 50-day SMA at $331.48 and the 200-day SMA at $395.44, BCH appears well-positioned for further gains.

CoinDesk reported on May 7 that BCH and Litecoin (LTC) both surged amid rising geopolitical tensions and macroeconomic instability, driving renewed interest in legacy cryptocurrencies with proven use cases. BCH, a fork of Bitcoin launched in 2017, continues to gain traction due to its lower fees, faster transactions, and scalable network.

Also Read: Ronin Price Prediction 2025, 2026 – 2030

The next immediate resistance stands near $449.00, but the current momentum suggests this level may soon be surpassed. Beyond that, the major profit target lies at $612.90 — a price last visited in late 2024. On the downside, new support levels at $378.20 and $331.16 are expected to hold firm in case of short-term corrections.

With improving sentiment, bullish CPM pivot indicators, and increasing adoption in payment networks and DeFi protocols, BCH is once again making a strong case for relevance in the crypto market.

If the bullish momentum continues, a sustained rally toward $612.90 could be well underway, positioning BCH as a serious contender in the next phase of the market cycle.

Comments

0 comment