views

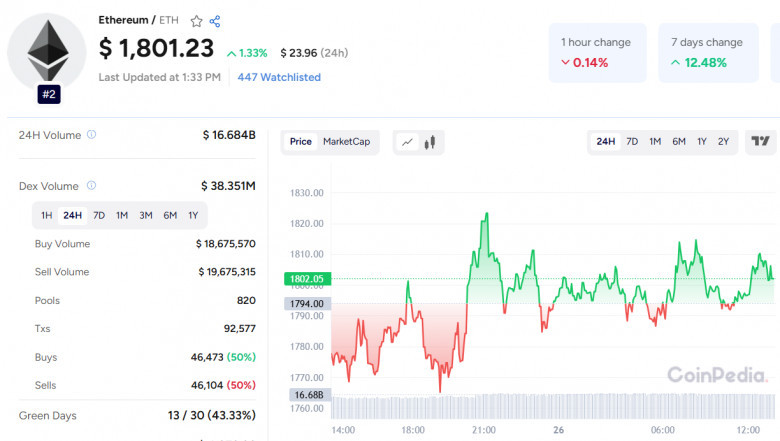

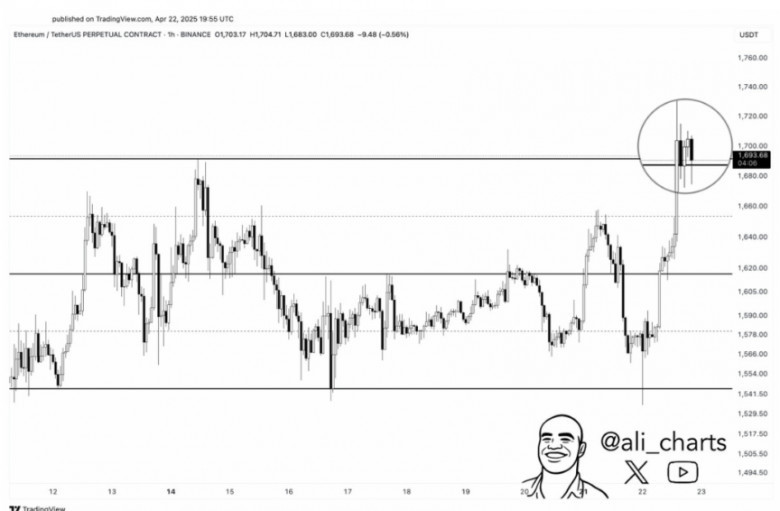

Ethereum is showing renewed strength following a recent correction, now trading above $1,700 — a 12.2% weekly gain that has caught the attention of analysts and traders alike. The recent upswing has brought optimism, sparking fresh discussions around Ethereum price prediction, even though ETH remains down around 63% from its 2021 all-time high of $4,878.

Technical indicators are flashing bullish signals. Most notably, Ethereum just printed a Golden Cross — where the short-term moving average crosses above the long-term one — a classic sign of potential trend reversal. Supporting this, ETH has entered the lower band of the Ichimoku Cloud, and a breakout above it could signal strong bullish momentum ahead.

At $1,776, Ethereum is not yet at its yearly high, but indicators like the Tenkan-Sen crossing above the Kijun-Sen suggest that bulls might be preparing for another run. Analysts say that a sustained move above $1,720 could clear the path to $1,850.

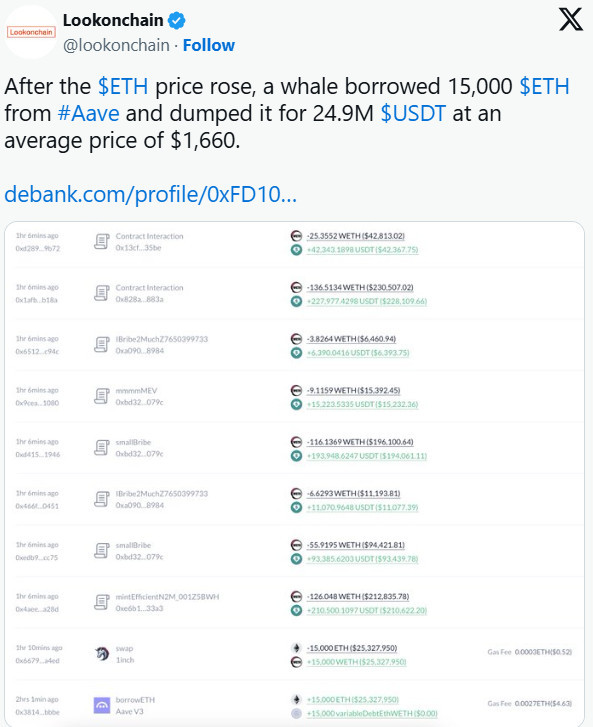

However, whale activity raises caution. An Ethereum Foundation-linked wallet moved 1,000 ETH to Kraken, and a separate whale offloaded 15,000 ETH (worth ~$24.9M) after borrowing from Aave. These moves, particularly following a rally, could indicate short-term profit-taking pressure.

Also Read: VeChain Price Prediction 2025, 2026 – 2030

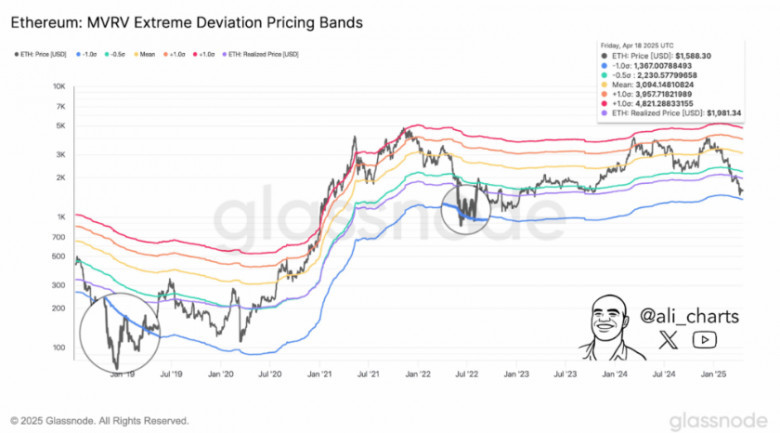

Meanwhile, on-chain data offers a long-term bullish case. Ethereum’s MVRV pricing bands place the asset in an accumulation zone, with market price at $1,588 and actual value estimated near $1,981. Historical patterns from 2018 and 2022 suggest that this band often aligns with market bottoms.

ETH/BTC remains near historic lows around 0.01835, reflecting underperformance relative to Bitcoin. But any shift in sentiment toward Ethereum's ecosystem could change that dynamic.

With growing dev activity, rising user interest, and bullish technicals, Ethereum may be gearing up for its next breakout — but eyes remain on whale behavior and macro conditions.

Are we witnessing the calm before the next Ethereum storm?

Comments

0 comment