views

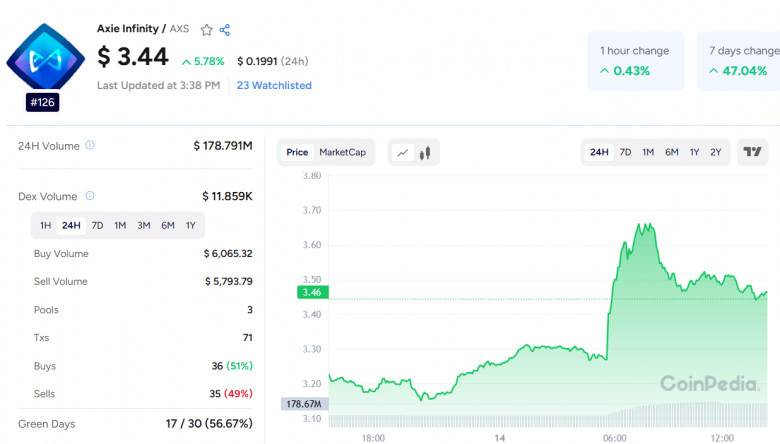

Axie Infinity (AXS), once a top project in the play-to-earn gaming space, is now trading at $3.44, with a 24-hour trading volume of $178.79 million. While it gained 0.23% in the last hour and 5.78% since yesterday, its overall performance paints a more cautious picture. The token is down 47.41% year-to-date and 52.17% over the past year, raising questions around its long-term potential and Axie Infinity price prediction.

Current Trends and Technical Indicators

The 50-day Simple Moving Average (SMA) is at $2.63, indicating a short-term upward trend. However, the 200-day SMA sits at $4.80, showing long-term resistance. This suggests that while there may be room for short-term gains, AXS needs stronger momentum to break past long-term barriers.

Why Volatility Might Be a Good Sign

AXS has a high volatility of 91.90%, a common trait in the crypto market. While risky, such volatility often precedes significant price movements. For investors familiar with crypto cycles, this could signal a potential rebound phase.

Token Supply and Scarcity

-

Circulating supply: 161 million AXS

-

Total and max supply: 270 million AXS

With a capped supply and growing interest in decentralized gaming, scarcity could become a key driver for future price appreciation.

Also Read: FTT Price Prediction 2025, 2026 – 2030

How AXS Compares to Bitcoin and Ethereum

In contrast, Bitcoin posted a 10.19% gain last year, while Ethereum fell by 22.45%. AXS’s deeper losses reflect the added pressure on niche tokens but also suggest greater upside during bullish cycles.

Looking Ahead to 2025

Some analysts and investors remain optimistic, projecting that AXS could reach $70 by 2025. While this goal is ambitious, the combination of volatility, capped supply, and rising interest in GameFi could make Axie Infinity worth watching closely

Comments

0 comment