views

TRON (TRX) is currently trading at $0.262815, down 3.37% over the last 24 hours. While the broader crypto market also declined by 2.84%, TRX slightly underperformed. The token also dropped 3.43% against Bitcoin today, despite maintaining an overall bullish outlook. Given the recent volatility, many traders are closely watching for signs to refine their TRON price prediction in the short term.

Over the past month, TRX has gained 8.95%, and its 3-month price change stands at a solid 10.27%. On a longer-term view, TRX is still up 114.32% year-over-year—an impressive performance considering it traded at $0.122629 a year ago.

Technically, TRX remains above key support levels. SMA100 and SMA200 are converging near $0.23, now seen as a strong support zone. Traders are watching SMA50 closely; if TRX stays above it, the bullish momentum could persist.

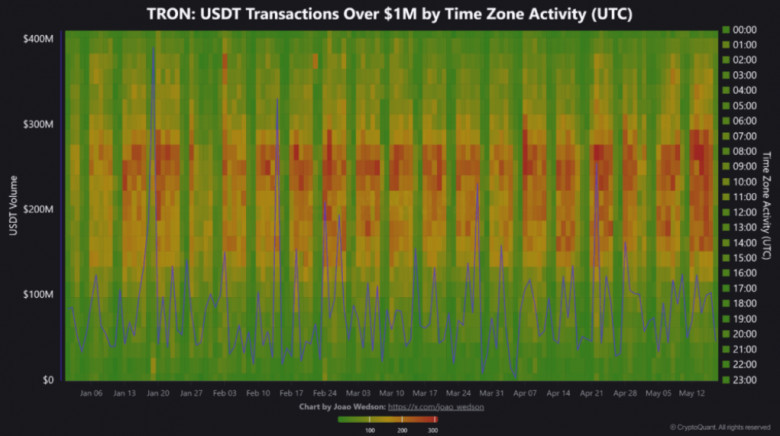

Notably, recent TRON blockchain data reveals that large USDT transfers—above $1 million—peak during 07:00 to 15:00 UTC. This timeframe aligns with European and U.S. market openings, indicating that institutional players dominate these hours.

Also Read: Pol Price Prediction 2025 - 2030

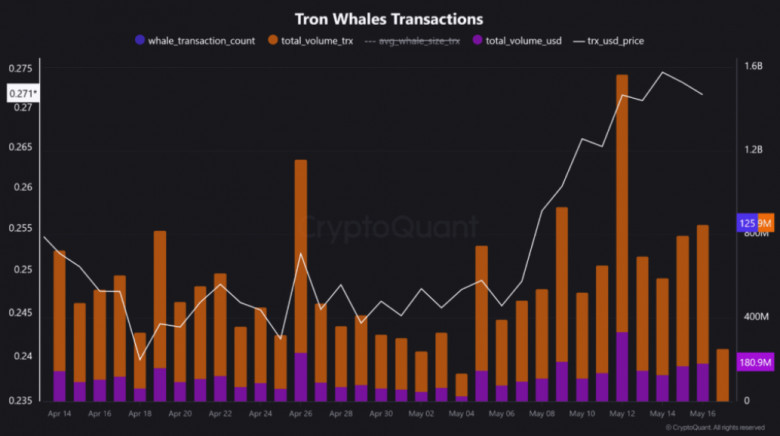

Whale activity surged after a golden cross in early May but has since tapered off. Interestingly, retail traders appear to be driving the current price action, with TRX still moving higher despite a slowdown in whale participation.

That said, TRX is nearing overbought territory, which could signal a short-term correction. Support is being closely watched at $0.25. If the price rebounds above it after a dip, the trend may resume. A drop below $0.24, however, could invite a deeper correction.

For seasoned crypto traders, these signals point to a maturing trend. While long-term momentum is strong, short-term caution is warranted. Monitoring whale activity, institutional hours, and support zones will be key for navigating the next TRX move

Comments

0 comment