views

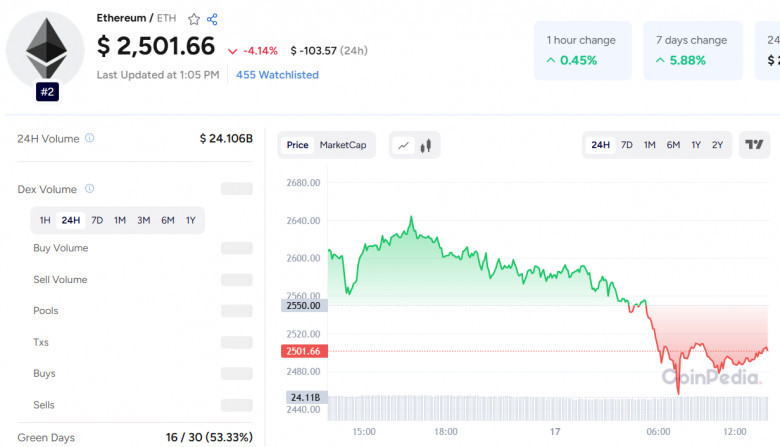

Ethereum (ETH-USD) is showing impressive strength, gaining nearly 58% in the past 30 days and 17% over the last week. Even after a modest 2.47% pullback in the last 24 hours, ETH remains in bullish territory, currently trading around $2,529. It recently touched a high of $2,736, and the next major resistance is now projected at $3,100. With this strong momentum, many analysts have adjusted their ETH price prediction upward. However, some caution is advised as the Relative Strength Index (RSI) signals overbought conditions, which could lead to short-term corrections.

Pectra Upgrade Brings Big Changes

One of the key drivers behind Ethereum’s recent surge is the Pectra upgrade, which launched on May 7. This major network update enhances scalability, introduces gasless transactions, and adds session-based permissions — making Ethereum more user-friendly. More than 5,500 transactions and over 11,000 authorizations were recorded within the first week of its launch, signaling strong adoption.

Bitget Wallet COO Alvin Kan believes that if wallets can simplify Ethereum’s complexity, Pectra could bring in a wave of new users by improving speed, reducing Layer 2 fees, and enhancing bridging between networks.

Also Read: Apecoin Price Prediction 2025, 2026 – 2030

Other Factors Supporting Ethereum's Growth

Ethereum’s price growth also reflects broader trends in the crypto space:

-

Increased stablecoin adoption and asset tokenization are pushing Ethereum’s use as foundational infrastructure. Stripe’s $1.1 billion acquisition of Bridge and Meta’s renewed stablecoin interest highlight this trend.

-

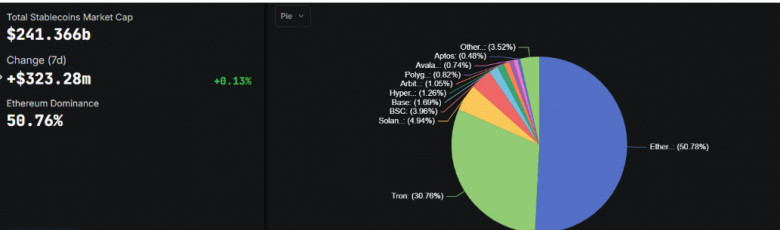

Ethereum hosts over 51% of all stablecoins, giving it a strong advantage.

-

Institutional interest in Layer 2 platforms like Base is rising. Robinhood’s acquisition of WonderFi points to Ethereum's growing role in tokenized equity markets.

Ethereum is gaining traction not just as a cryptocurrency, but as critical infrastructure powering the future of digital finance

Comments

0 comment